Tax shields and bankruptcy

- Gianmarco Forleo

- 24 mar 2019

- Tempo di lettura: 9 min

TAX SHIELDS

When a firm chooses to finance its activities using debt, it enjoys benefits related to the fact that the interest the company pays to its debt holders is an expense that can be deducted from taxes. The amount that the company saves from taxes is called tax shield. Consider the following income statement of a firm that has to pay back a debt with an interest rate of 10% and with a tax rate of 40%:

As you can see the firm avoided, thanks to the tax shield, $800 of taxes. You can calculate the present value of the tax shield supposing that the debt of the company is fixed and permanent. We can calculate it as a perpetuity using as discount rate the company’s marginal company discount rate. We can approximate this rate to be equal to the interest rate asked by debtholders.

But remember that the interest payment the firm has to pay is computed as:

So we can rewrite the present value of the tax shield as:

So, as you can see, the present value of the tax shield is independent of the return promised to debtholders.

MODIGLIANI AND MILLER THEORIES WITH TAXES

According to Modigliani and Miller, the value of the firm does not change when the firm changes its capital structure. However, in the real world, we do not have to consider only debt and equity, but also taxes. The taxes claimed by the government are liabilities for the firm. Shareholders therefore share the profit of the firm with the government too. A firm can make its shareholders better off by reducing the size of the government claims on the profits. In order to do so, the firm can issue more debt, so to obtain a tax shield and increasing the cashflow destined to equity and debt investors. By taking into account taxes, the value of the firm becomes:

Since both for the company and the shareholders is convenient when more debt is issue, when should a firm stop borrowing money? We considered that the stockholder’s wealth and the firm value increase as the amount of debt increases. This would imply in theory that a company should be financed entirely by debt. However, until now, we considered the firm’s debt as fixed and everlasting and, in reality, this is not the case because the ability of the firm to carry debt is now always the same. Furthermore, companies face often lower tax rates than the one we considered and a firm can use the tax shield only on future profits. By issuing an excessive amount of debt the firm can incur in the risk of not having a profit to save in the future.

FINANCIAL DISTRESS

Financial distress is described as a situation in which the firm can not pay its creditors or it can do so with difficulty. If this happens, the company risks bankruptcy. Because investors are aware that levered firms carry also that risk, the market value of the firm is adjusted to take it into account:

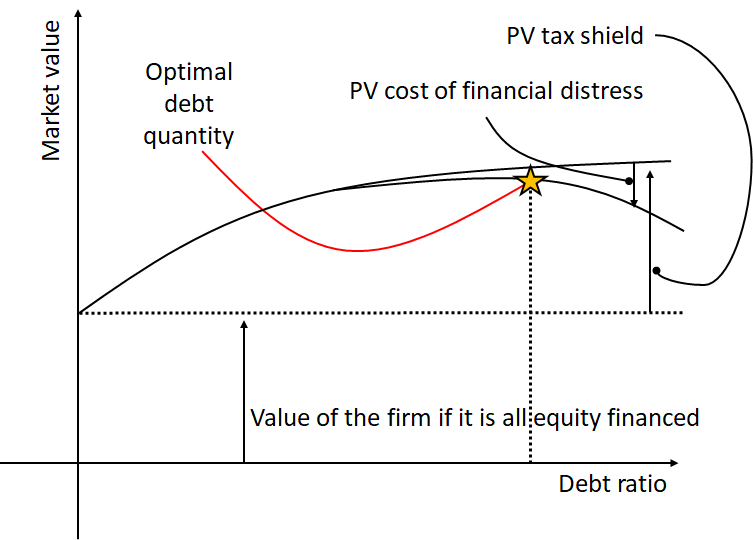

Value of the firm = value if financed entirely by equity + PV(tax shield) – PV (cost of financial distress)

The last component of the value depends on the probability that financial distress happens and its consequences if it occurs. Initially, as the debt increases, the present value of the tax shield increases. When debt is small, the probability of financial distress is small and, therefore, the advantages of issuing more debt are more than the disadvantages. But, when the firm reaches an excessive level of debt, the probability of financial distress increases rapidly and it is not convenient anymore for the firm to issue more debt. The optimal level of debt is reached when the advantages of borrowing exactly compensate for the disadvantages. This attempt to balance tax shield and the cost of financial distress is called trade-off theory or static theory. The pecking order principle furthermore says that, because of information asymmetries, for the company is cheaper to use internal financing rather asking money to stockholders. This implies that a firm will at first use the internal financing then it will use debt (until it is optimal to do so) and lastly equity financing.

WHAT HAPPENS IF BANKRUPTCY HAPPENS

Bankruptcy happens if stockholders exercise the so called “right to default”. This right is exercised thanks to the limited liability that stockholders enjoy. When equity holders enjoy limited liability, if the firm is not able to pay back its creditors, they are not asked to repay those creditors using their own money. You can understand how much this right is valuable by considering two identical firm but with only one of them giving its stockholders the right of limited liability. Obviously in reality stockholders always enjoy this right, so we are making an example just to make you understand how much this obvious right is worth. Suppose that each firm has to pay back $10,000 to debtholders. If the firm’s assets are valuable enough to pay back the debtholders nothing happens to the shareholders: the assets are simply sold and the debt paid back. If however, the company’s assets are not enough to pay back the $10,000, the shareholders will have to pay that difference if they don’t enjoy limited liability rights. If, for example, the assets are worth only $5,000 the shareholders will be called to pay the other $5,000 to the debtholders. Notice that the combined payoff of debtholders and stockholders is the same regardless of whether the stockholders enjoy the right of limited liability or not.

Bankruptcy happens therefore when the firm is not able to pay back its creditors because of the decline in the value of its assets. After bankruptcy is declared, the assets of the company are sold to pay back debtholders and stockholders are left with nothing (because the company they own is shredded into pieces). Being bankruptcy a legal mechanism, it carries costs. Before paying back the debtholders, part of the remaining value of the assets has to be used to cover those bankruptcy costs. In the imaginary case that stockholders did not enjoy the rights of limited liability, they would have to pay for those costs too.

Among the costs of bankruptcy, you should not consider only the direct ones to finance legal procedures but also indirect ones which are, however, difficult to measure. When a firm declares bankruptcy, the bankruptcy court is responsible for taking some of the firm’s last decisions such as how and when to sell the assets. It could happen that the court would be willing to help saving the firm from bankruptcy by investing in new projects but that impatient creditors push in order to sell the remaining assets as soon as possible. It may also happen that the court is so convinced of its ability to rescue the firm that it starts engaging in negative NPV activities to do so. Not always firms in financial distress declares bankruptcy. It may postpone it for many years or avoid it completely. Being in financial distress is not an easy situation for the firm also because both customers and suppliers will not be willing to enter in business with that company. Furthermore, employees will search for other job places and potential new ones will not accept to be hired by such firm.

BAD GAMES

Both the stockholders and the bondholders prefer if the firm recovers but it is possible that, when choosing the way in which the firm should do so, they have different interests. This is because shareholders are always focused on maximizing the market value of the firm while bondholders want the firm to recover by following the most prudent way possible. Consider the following income statement of the company:

If the bonds matured now, this firm would be forced to declare bankruptcy, the shareholders would exercise their right to default, and the assets would be sold to pay back the debt holders. But now, suppose that the firm’s debt matures in 1 year and therefore the firm has still some possibilities to be saved from bankruptcy. The conflict between shareholders and debtholders interests could lead to stupid behaviours.

Suppose that the firm has still $50 of cash that can be used to finance an investment that could provide revenues of $300 with 10% probability or 0 with 90% probability. This investment has NPV equal to: -50+0.1*300+0.9*0= -20. Imagine that the firm uses the money to purchase this investment, the income statement will modify as follows:

The value of the firm is decreased but, because the value of the bonds decreased, the value of the stocks increased. Because, if the firm goes bankrupt, shareholders lose all their money, they will bet in order to avoid bankruptcy at all costs. As you can see, stockholders, when pursuing their own self interests, are willing to decrease the firm’s value by betting with the money of debtholders. Theywould instead prefer to sell all the assets right away if this negative NPV investment is the only one available to the firm. Those kind of active selfish behaviour are called: errors of commissions.

Conflicts of interests may also lead to other kind of selfish behaviours: errors of omissions in which the firm does not act in the interest of both its share and debt holders. Assume that the same company as before can instead consider the purchase of a safe asset that costs $50 but with a present value of $75 and a NPV of $25. However assume that the company does not possess any cash and, in order to buy that asset, is would have to issue new stocks. Suppose that the firm decides to issue those stocks and purchase the investment. The income statement will modify as follows:

The value of the company goes up as the common stock. However, contrarily to what you could expect, it does not go up by $50 but slightly less. This is because, as the firm purchases new safe assets, the probability of default is less and, in the case it happens, the firm would have more assets to pay back the debt and therefore the value of the firm’s debt increases as well. The debtholders receive what the shareholders do not. So, even though shareholders are asked to put $50 the common stock goes up only by $25 because the debt increases by $25 as well. Because shareholders have to share the profits of the assets bought with their money, they could skip this positive NPV investment thus increasing the chances of bankruptcy.

As we just saw, shareholders may be unwilling to put other money to save the company but they will surely be happy to take money out of it to receive dividends. By doing so, they reduce the amount the firm can use to repay its creditors.

In case of financial distress, creditors prefer the firm to sell all its assets as soon as possible in order to avoid other problem that could further reduce their value. Shareholders instead are interested to delay it as long as possible hoping that the company would recover.

If a firm initially issues a small amount of safe debt. By then issuing a lot of debt it reduces the value of the safe old debt. The shareholders have interests in doing so because they earn what those creditors lose.

HOW TO AVOIG THOSE GAMES

Often, when a company is in a financial distress, the debt contracts with debtholders stop the firm from paying dividends to shareholders if there are not enough money to pay back the borrowed money. There are also some cases in which the debtholders authorization is required when the firm wants to buy expensive investments. Obviously all this control process and the process of writing contracts including all the possible conditions and situations that could happen, is not for free. Costs are involved both in order to do so and in order to monitor the activities of managers. Those costs will reduce the firm’s profits and shareholders dividends. Debtholders prefer if the firm does not use risky assets and therefore they could turn down positive NPV projects if they are considered too risky. It is important to remember however that human imagination can not cover all the possible scenarios that can happen in the future and therefore, even with high legal expenditures, contracts will be always exposed because of their incompleteness.

HOW THE NATURE OF ASSET CHANGES FIRM’S BEHAVIOUR

If a firm possesses a lot of real tangible assets like buildings, machinery or land, then in case of bankruptcy, the assets are sold, the debt repaid and the bankruptcy costs involve only legal fees or real estate commissions. Conversely, if a firm does not possess a lot of tangible assets, even if it possess huge intangible assets like human resources, brand name or technology, in case of bankruptcy, the debtholders will be in trouble because, unlike tangible assets, intangible assets keep their value only if the company will be able to continue with its business. The brand name of a company, for example, decreases in value when its common knowledge that it will shut down in a short period of time. A company valuable mostly for its human resources will see those same human resources go away when they are aware that they could become unemployed in a few months. And the precious relationships with customers (another intangible asset), could disappear if they are aware that the company with which they are conducting business might disappear soon. This is why companies like Google or Microsoft, which have extremely valuable intangible assets but few fixed assets (when compare to the intangibles) are almost entirely financed by equity.

HOW TO CHOOSE THE RIGHT CAPITAL STRUCTURE

When deciding how to finance their projects, firms face the debt-equity trade-off. On one side, firms get tax shields when using debt, on the other however, more debt means more risk of financial distress. The proportion of equity and debt used varies from firm to firm and it depends on various factors among which the nature of their assets. As said, companies with a lot of tangible assets, stable and constant cashflow should rely on high debt while unprofitable, risky companies with a lot of intangible assets should use more equity. However, this theoretical approach is insufficient to explain why in reality some of the most profitable companies don’t borrow a lot of money. It is impossible to give an answer valid for all the companies since each company is different and possess different assets. In general it is true that in reality companies are not so much influenced by the magnitude of the tax shields they will receive because they are more interested in the effects that debt has on the overall organization and its relationships.

Commenti