What is elasticity and why it is important

- Gianmarco Forleo

- 27 ago 2018

- Tempo di lettura: 6 min

ELASTICITY

In general elasticity is defined as a measure of how much agents in the market (so both buyers and sellers) react to a change in one of the market condition.

THE PRICE ELASTICITY OF DEMAND

It measures how the quantity demanded changes when the price of the good considered changes. It is computed as the ratio between the percentage change in quantity demanded and the percentage change in price.

Demand is said to be elastic if when price changes the quantity demanded changes in a substantial way. We can define a demand as elastic when its elasticity is greater than 1 (considering its absolute value) Conversely if demand slightly changes when price changes it is said to be inelastic. We can define a demand as inelastic when its elasticity is less than 1. A demand curve with elasticity exactly equal to 1 is said to have unit elasticity. Whether demand is elastic or not can depend on many factors like:

Availability of substitutes. If you have substitutes for the goods you are considering the demand for it will in general be elastic. Consider butter and margarine which are substitutes. If the price of one of the two rises you are more likely to consume the other one. Why would you buy something at a high price if you can buy something you value just as much at a lower price?

How much you really need the good. Commodities that are considered necessities like food or drugs tend to have inelastic demand while luxuries have generally elastic demands. If you need a specific drug be healthy, you will buy it at any price. If you are a millionaire and unfortunately the price for that brand new yacht you wanted to buy rises, you can consider buying a sport car or a plane (how sad must the life of a millionaire).

Time. Even if the demand of a good is inelastic in the short run it is not always the case that it must be so also in the long run. Consider a drug. In the short run it is essential for you to buy it to live healthy (and so, as said, it is inelastic), but in the future a new cheaper drug could be developed thus creating the availability of substitutes for consumers and so the demand for that drug will become more and more elastic.

A demand curve is said to be perfectly inelastic when elasticity is exactly 0 and graphically the demand curve is vertical. In this case, for any increase in price, the quantity demanded will always be the same. The opposite happens with a perfectly elastic demand. A demand curve is said to be perfectly elastic when the elasticity is ∞ and graphically the demand curve is horizontal.

COMPUTING THE PRICE ELASTICITY OF DEMAND

As said the price elasticity of demand is defined as the ratio between the percentage change in quantity demanded and the percentage change in price. By the law of demand we know that price and quantity demanded are negatively related. By convention anyway it is considered the absolute value of elasticity and therefore the minus sign is dropped. If you try to calculate the elasticity of demand using two points (which we call A and B) on the demand curve you will notice that the elasticity computed from point A to point B is different from the elasticity computed from point B to point A. To avoid this problem the price elasticity of demand is computed using the so called midpoint method. Thanks to this method, whether you compute the elasticity from A to B or from B to A gives no different result. The price elasticity of demand is computed as follows:

HOW FIRMS CAN USE ELASTICITY

Consider a firm who sells goods on the market. The total revenues of that firm are defined as P*Q which is the price at which the firm sells the good on the market multiplied by the quantity of the good sold. When a firm is deciding whether to sell its product at a higher price, at a lower price or to keep the price without any change it should consider elasticity. Let’s consider the three cases for elasticity and what happens to revenues:

Inelastic goods (E<1) in this case, when price raises, as we know customers (and therefore demand) will not respond in a substantial way to it. This means that an increase in price will cause a decrease in demand that is less than exactly proportionate to the increase in price itself (when raising price by 30% demand will reduce by less than 30%). This means that, when considering revenues (P*Q) , for the firm is more convenient to increase the price because revenues would be higher.

Elastic goods (E>1) in this case, on the contrary, when price raises, customers will respond in a substantial way. This means that an increase in price will cause a decrease in demand that is more than exactly proportionate to the increase in price itself (when raising price by 30% demand will reduce by more than 30%). This means that, when considering revenues (P*Q), for the firm is not convenient to increase the price because revenues would be lower.

Unit elastic goods (E=1) in this case, people will respond to a change in an exactly proportional way (when raising price by 30% demand will reduce exactly by 30%). This means that, when considering revenues (P*Q) the firm should be indifferent whether to increase or not the price because revenues will remain the same.

ELASTICITY VS SLOPE

It is important to stress the difference between the elasticity and the slope of a demand curve. Being a line, the slope of the demand curve is constant along the line but the elasticity is not. Remember that the slope is defined as the ratio between the change of the value on the y-axis and the value on the x-axis while the elasticity is the ratio of percentage changes of the two variables. In general the points on the demand curve with low price and high quantity are less elastic than the points where you have high prices and less quantity demanded.

THE INCOME ELASTICITY OF DEMAND

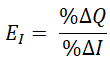

It measures how the quantity demanded changes when the income of a customer changes. It is computed as the ratio between the percentage change in the quantity demanded and the percentage change in the income.

Goods like food, drugs and other necessities tend to have small income elasticities because, regardless of your income, you need to buy them. An expensive watch or other luxuries have higher income elasticities because you won’t buy them (hopefully) if your income is too low.

CROSS PRICE ELASTICITY

Some goods can be related to one another. They can be substitutes (if when you consume one you do not consume the other) or complements (if when you consume one you consume also the other). When the price of one good changes, the quantity demanded of the related good can be affected as well. The cross price elasticity of demand measures how the quantity demanded of one good changes when the price of the related one changes. Consider two related goods: good 1 and good 2 and that we want to measure how much the demand of good 1 changes when there is a change in price of good 2. The cross price elasticity is computed as the ratio between the percentage change in the quantity demanded and the percentage change in the price of good 2.

In general if the two goods are substitutes the cross price elasticity is positive. Suppose that you have butter and margarine which are for most people substitute goods. If the price of butter increases then the demand for butter will be influenced positively (because it will rise). Conversely, if the two goods are complements, the cross price elasticity is negative. Consider a tennis racket and a tennis ball which are complement goods. If the price of tennis balls rises, playing tennis will become overall a more expensive activity. Therefore the demand for tennis rackets will be influenced negatively (because it will decrease).

THE PRICE ELASTICITY OF SUPPLY

It measures how the quantity supplied changes when the price of the good considered changes. It is computed as the ratio between the percentage change in quantity supplied and the percentage change in price.

Supply is said to be elastic if when price changes the quantity supplied changes in a substantial way. We can define supply as elastic when its elasticity is greater than 1. Conversely, if demand slightly changes when price changes it is said to be inelastic. We can define demand as inelastic when its elasticity is less than 1. A supply curve with elasticity exactly equal to 1 is said to have unit elasticity. A supply curve is said to be perfectly inelastic when elasticity is exactly 0 and graphically the supply curve is vertical. In this case, for any increase in price, the quantity supplied will always be the same. The opposite happens with a perfectly elastic supply. A supply curve is said to be perfectly elastic when the elasticity is ∞ and graphically the supply curve is horizontal.

If you try to calculate the elasticity of supply using two points (which we call A and B) on the supply curve you will notice that the elasticity computed from point A to point B is different from the elasticity computed from point B to point A.

To avoid this problem the price elasticity of supply is computed using the so called midpoint method. Thanks to this method, whether you compute the elasticity from A to B or from B to A gives no different result. The price elasticity of supply is computed as follows:

Commenti